TAX3704 Lesson 1 Study material relating to capital allowances for tax purposes. (Part A) We

Claim capital allowances so your business pays less tax when you buy assets - equipment, fixtures, business cars, plant and machinery, annual investment allowance, first year allowances.

Capital allowances a stepbystep guide Accountancy Age

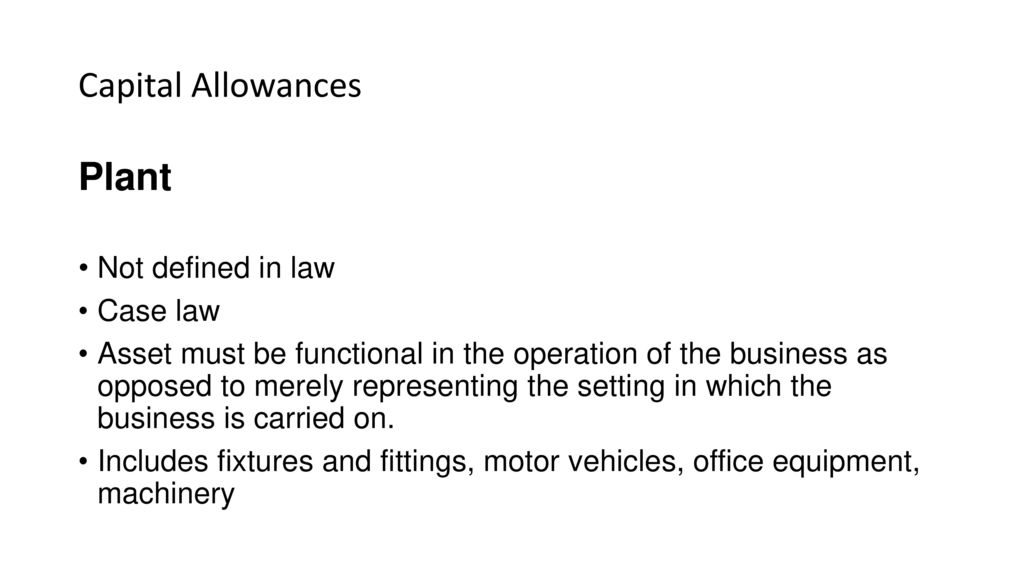

In order for fixtures and fittings to be plant they must be of a durable nature, that is they must satisfy the 2-year test CA21100, and they must be apparatus for the purposes of the trade. Treat.

Introduction Capital Allowances Depreciation specifically disallowed ppt download

Capital Allowance Pools. There are two distinct capital allowance pools for fixtures and fittings. One pool is for moveable items such as tables, chairs, and machinery, etc. In contrast, the other pool is for fixed items. This includes plumbing, electrical systems, radiators, door handles, etc. For tax purposes, the value of the fixed items.

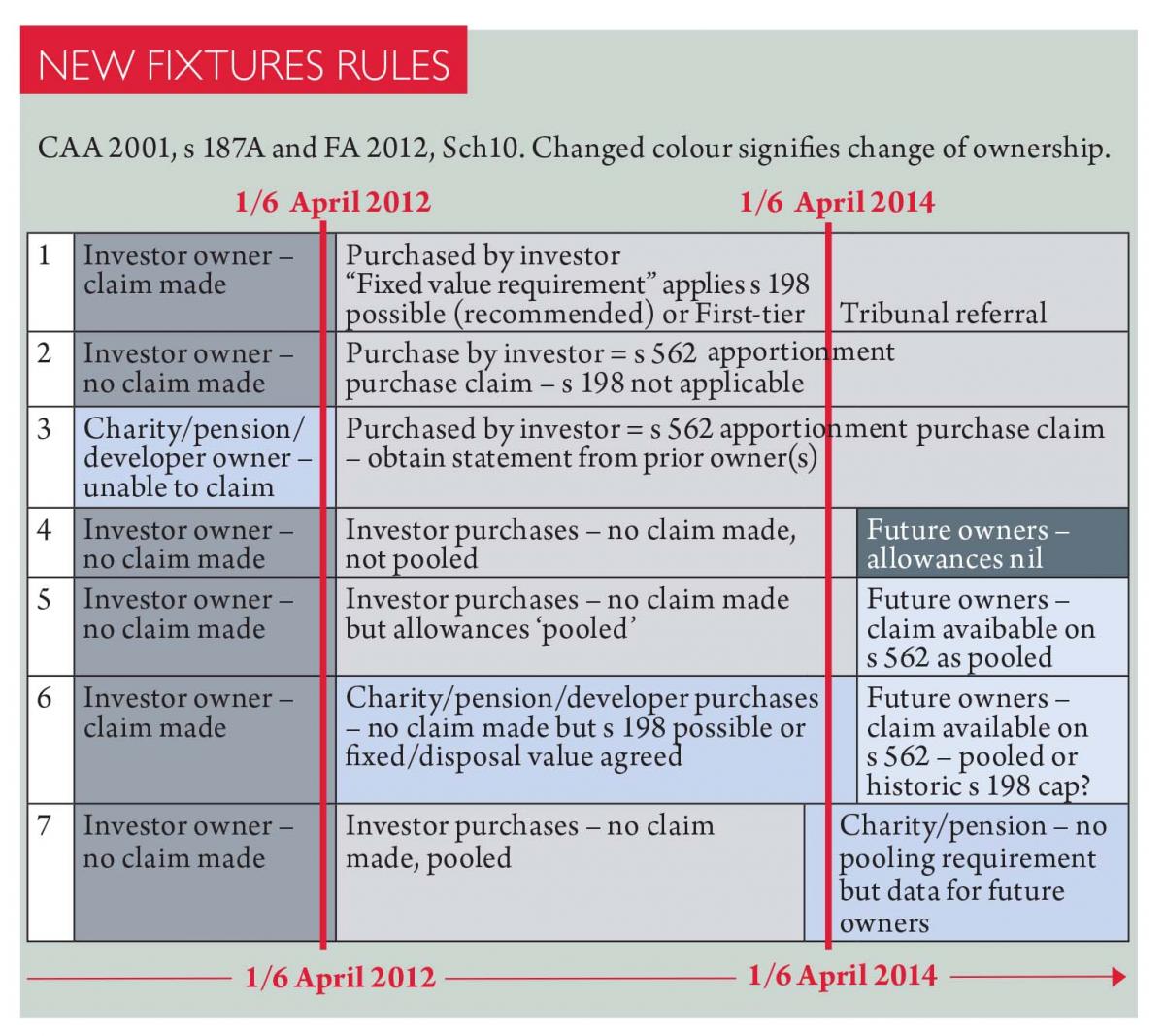

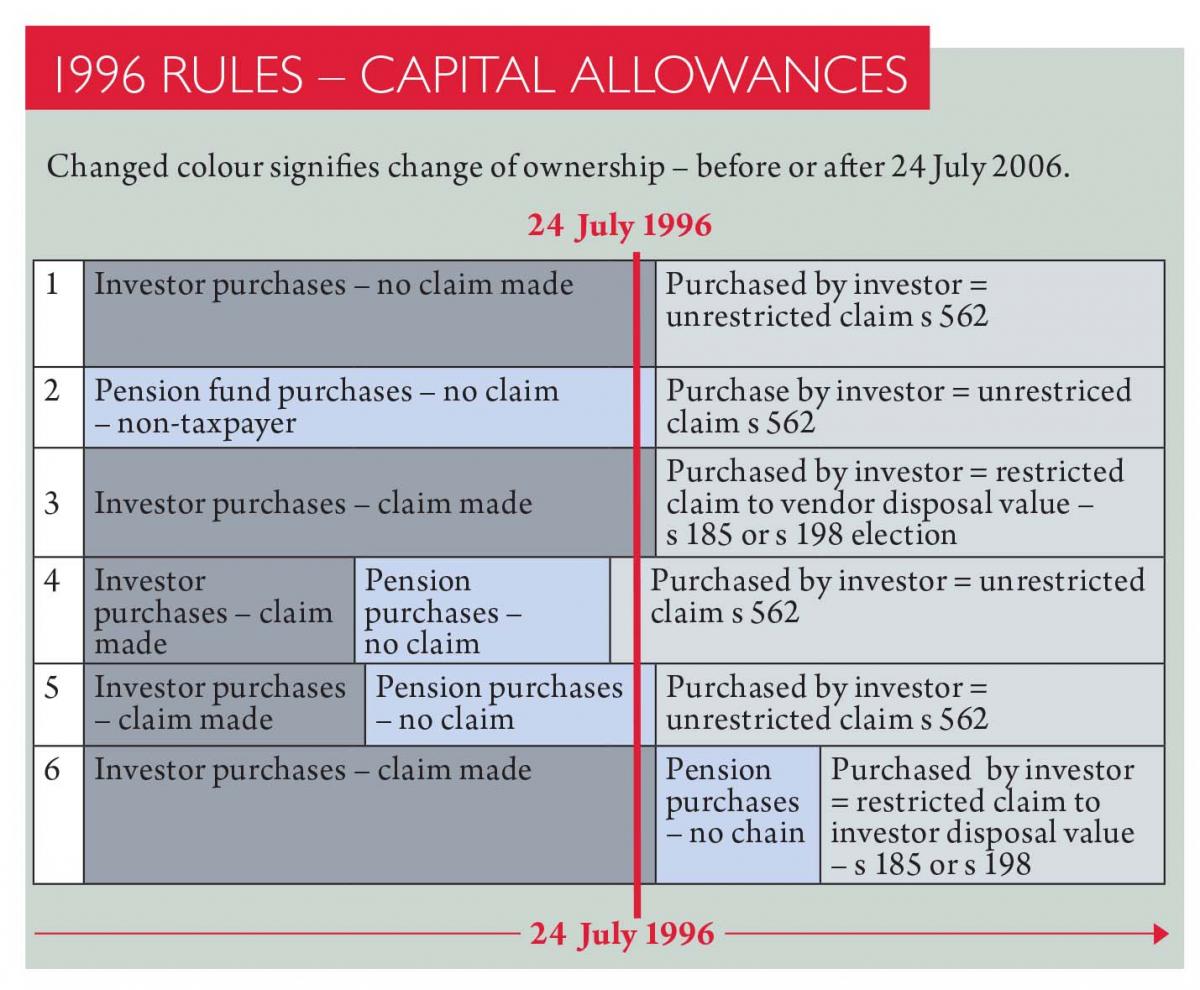

Six Forward Capital Allowances Fixtures Elections SixForward capitalallowances YouTube

Beth is buying a care home from Sandra. Sandra built an extension in late 2012, paying the main contractor £150,000 and spending a further £30,000 on fitting it out. She claimed allowances for the £30,000, but no claim was made for any part of the £150,000. Beth's advisers show that £40,000 of the £150,000 relates to fixtures.

Integral Fixtures And Fittings Capital Allowances FitnessRetro

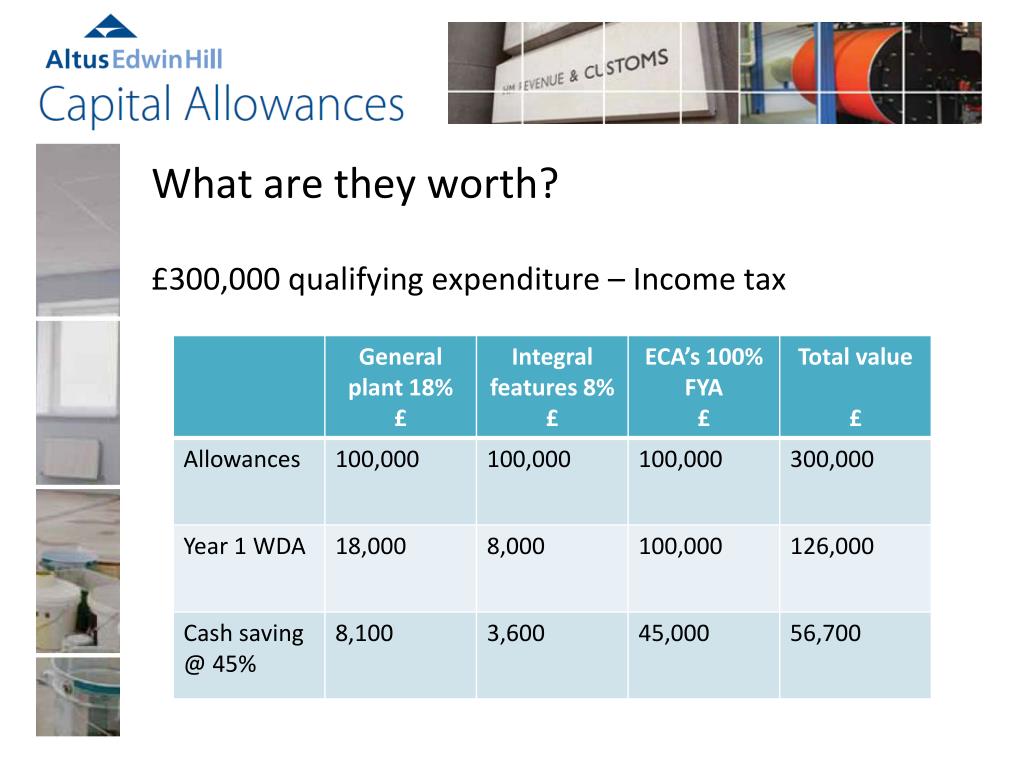

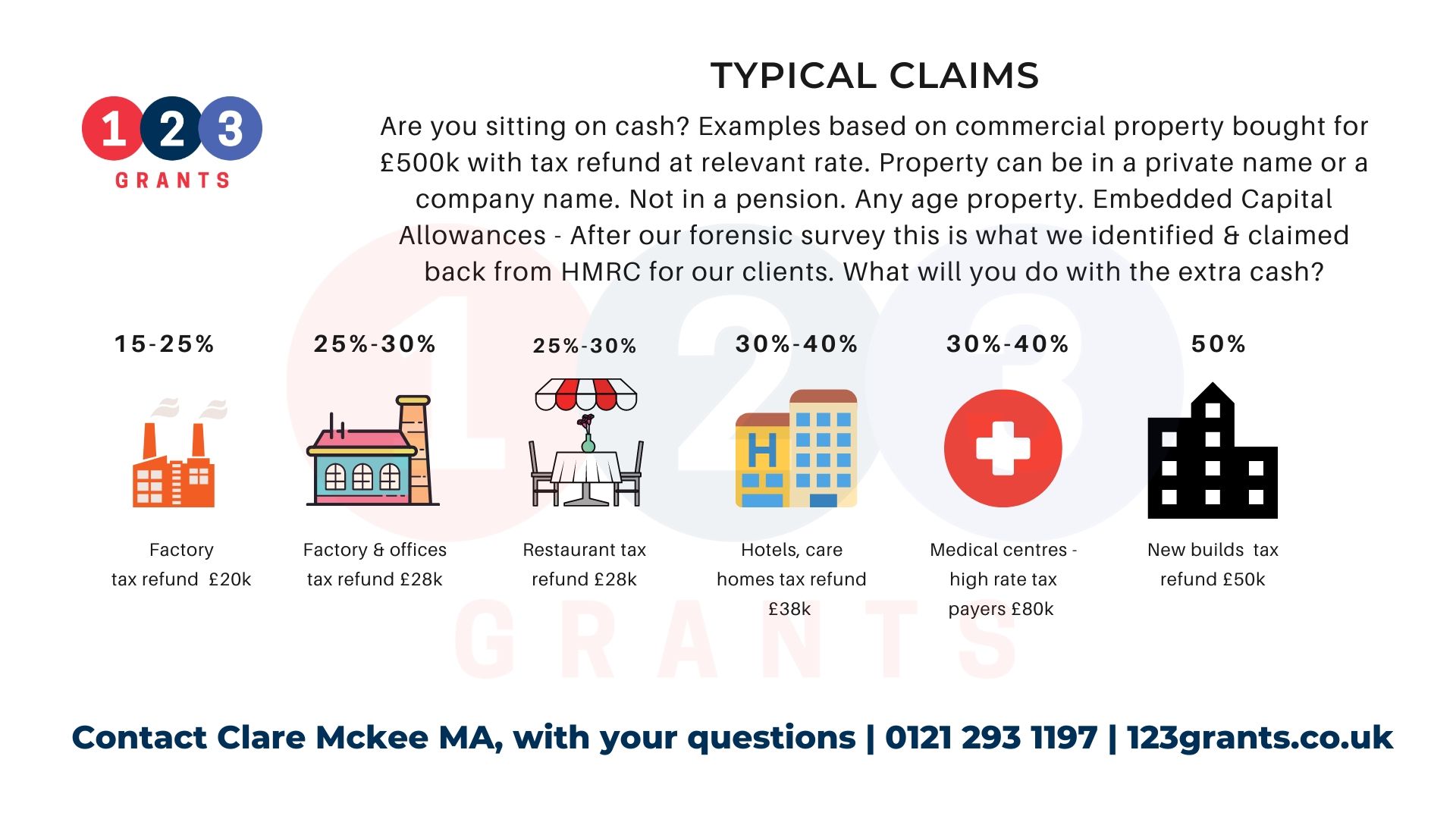

The starting point is simply to appreciate the fact that capital allowances for commercial properties are potentially very valuable. There are many variables here, but tax relief may typically be available for between 15% and 45% of the cost of a property. A simple warehouse will be at the lower end, whereas a care home or upmarket hotel may be.

Fixtures and fitting on transfer of ownership Thompson Taraz Rand

Sara cannot claim plant and machinery allowances for the entire amount of £75,000, but can claim for the part of the £75,000 that relates to "fixtures" in the extension. Suppose that the correct value for these fixtures is £50,000 (two thirds of the total cost of the extension). Sara can claim immediate tax relief at 40% on the £50,000.

PPT Capital Allowances An Overview PowerPoint Presentation, free download ID2203736

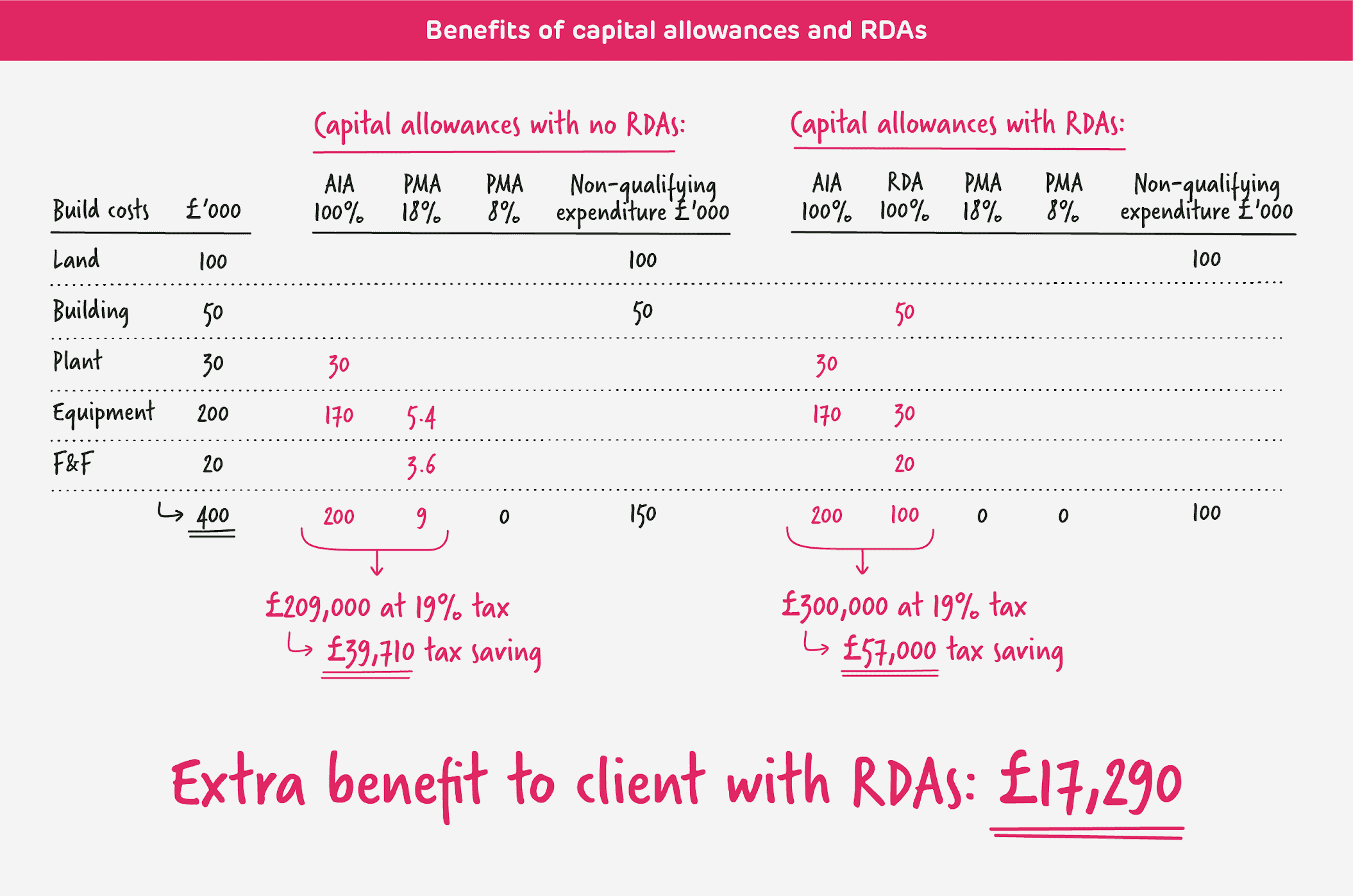

The new tax reliefs covering capital allowances that businesses should be aware of are: A 'super deduction' of 130% for spend on new qualifying assets. A first year allowance of 50% on most new plant and machinery expenditure that would normally qualify for the special allowance on fixtures and fittings which are an integral part of a building.

The balance sheet of a sole trader revealed the following position. Fixed Assets R R Land

There is no limit to the amount of spend that can benefit from the 130% super-deduction. This is different from the super-deduction's nearest capital allowances equivalent, the 100% "annual investment allowance" (AIA), which has a maximum cap of £1,000,000 of qualifying spend each year and will reduce to just £200,000 from 1 April 2023.

What are Capital Allowances and how can you benefit? Chapman, Robinson & Moore

They will need to work out any balancing allowance or balancing charge for capital allowances (see CA23210) and any Capital Gains Tax reliefs will be affected (see CG63950P onwards in respect of.

Capital Allowances Commercial Property Unlock £000's 123 Grants

Unlocking the Value of Capital Allowances on Fixtures and Fittings. Posted 25th May 2023 by by Ilyas Patel. The fixtures and fittings within your office, Furnished Holiday Let or commercial property may provide you with invaluable savings that could be used to grow your business. On today's Tax Tip, find out how to claim capital allowances on.

Hotel & Apartments Capital Allowances Case Study Six Forward

Accountants use the term "fixtures and fittings" quite loosely, but the law defines precisely what is meant by "fixtures" for capital allowances purposes. In the capital allowances sense, fixtures are just one type of plant and machinery. More specifically, a fixture is an item of plant or machinery that is so installed in or to a.

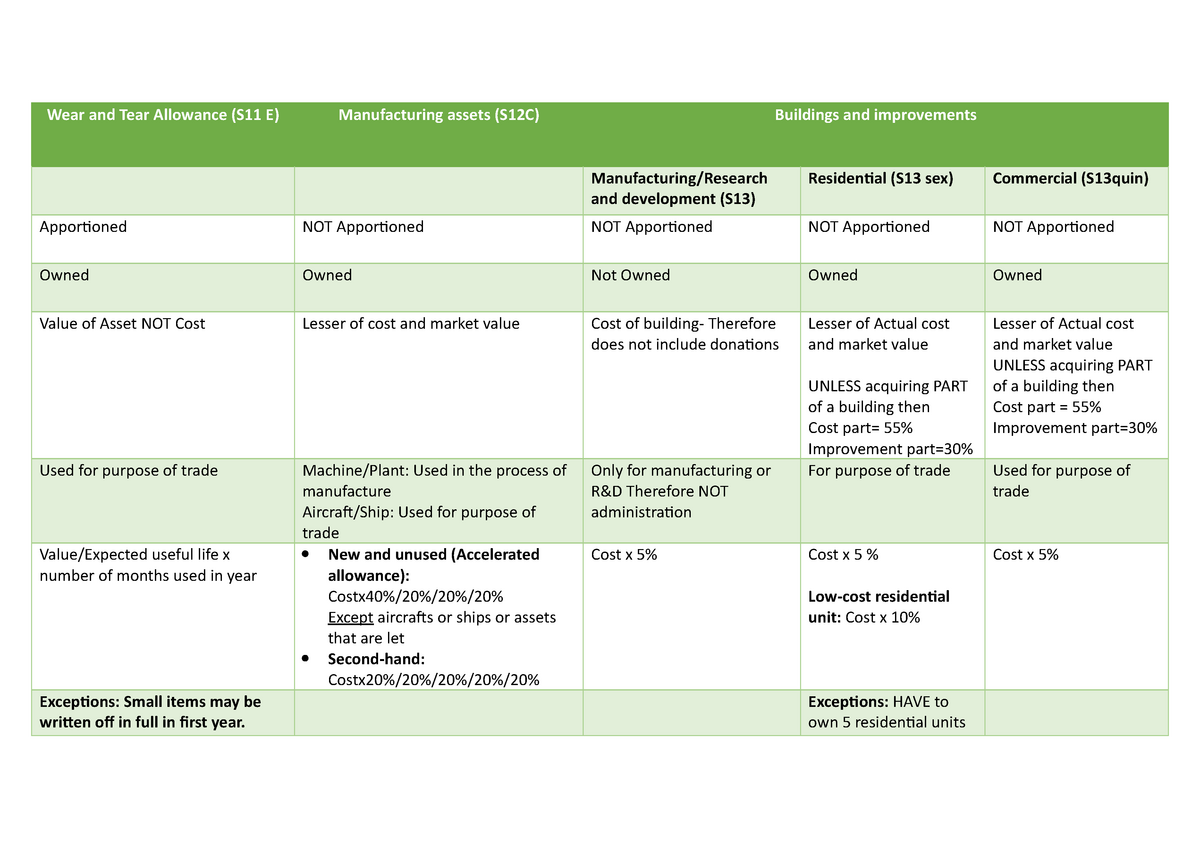

Capital Allowances Wear and Tear Allowance (S11 E) Manufacturing assets (S12C) Buildings and

Property Embedded Fixtures and Fittings or PEFFs for short, are an aspect of capital allowances that are frequently missed. Items classed as PEFFs are embedded in the building. Or more simply put, if you turned the building upside down, these items would remain inside the building. Embedded items could be screwed, nailed, plastered or even.

Capital Allowances Claims & Fixtures Six Forward

Current law. Capital allowances provide tax relief for the depreciation of certain capital assets, principally plant or machinery, including most fixtures in a building used by a business. They take the place of commercial depreciation, which is not deductible for tax purposes. The allowances are calculated as a percentage of the capital.

Integral Fixtures And Fittings Capital Allowances FitnessRetro

A straightforward example is the cold water system, which is part of the building but which qualifies for plant and machinery allowances as an integral feature. Your client may be able to claim capital allowances in respect of fixtures in the new premises. It is assumed that your client has purchased the building; however, in some circumstances.

IE Capital Allowances Template Accountant's

Property Embedded Fixtures and Fittings (PEFFs) is a niche part of Capital Allowances and often the most significant capital allowance that can be claimed by Commercial Property owners and investors. This tax benefit is available to UK taxpayers and is used to generate a tax refund where possible and/or used as a tax credit to reduce future tax.

R&D Capital Allowances & R&D Capital Expenditure Explained

What qualifies for capital allowances? If your client has spent capital buying, and/or improving commercial property, they may be entitled to tax relief. A proportion of the Property acquisition expenditure can be divided to identify qualifying embedded fixtures and fittings (over and above chattels).