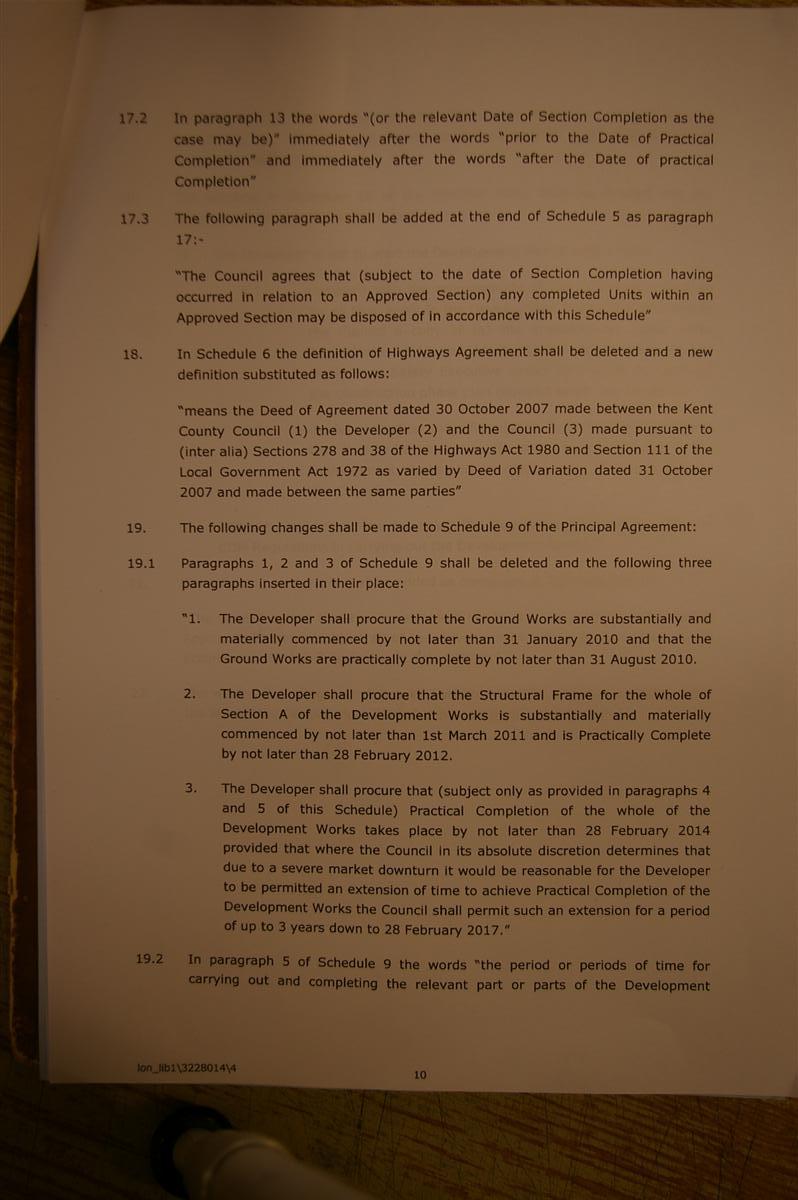

Deed of Variation 3rd September 2009

For the deed of variation to be effective for IHT and CGT purposes, the *four conditions which must be met are: it must be made within two years of the date of death (and this cannot be extended) it must be in writing (in practice, a deed is usually used) it must not be for money or money's worth. it must include a statement of intent for the.

Deed Template Free Printable Documents

This is our Deed of Variation for Will template. Use it when a person dies who has left a Will and the beneficiaries want to change who inherits. This is a way to change a will after death. You would generally use a Deed of Variation after obtaining the Grant of Probate. This would mean the Executors have the proper authority to manage the assets.

What is a Deed of Variation Braintree Wills Essex

A deed of variation, sometimes called a deed of family arrangement, allows beneficiaries to make changes to their entitlement from a Will after the person has died. You might want to do this if you don't need all your inheritance and would like it to go to someone else. It can also help minimise inheritance tax.

Deed Of Variation Template Letter

There is no cost associated with a deed of variation as you are simply writing a letter, unless you use professional services. In this instance costs range between £200 to £750 depending on the solicitor fees and the complexity of the change. Although costly, using a solicitor may be worthwhile if you want to ensure no mistakes are made.

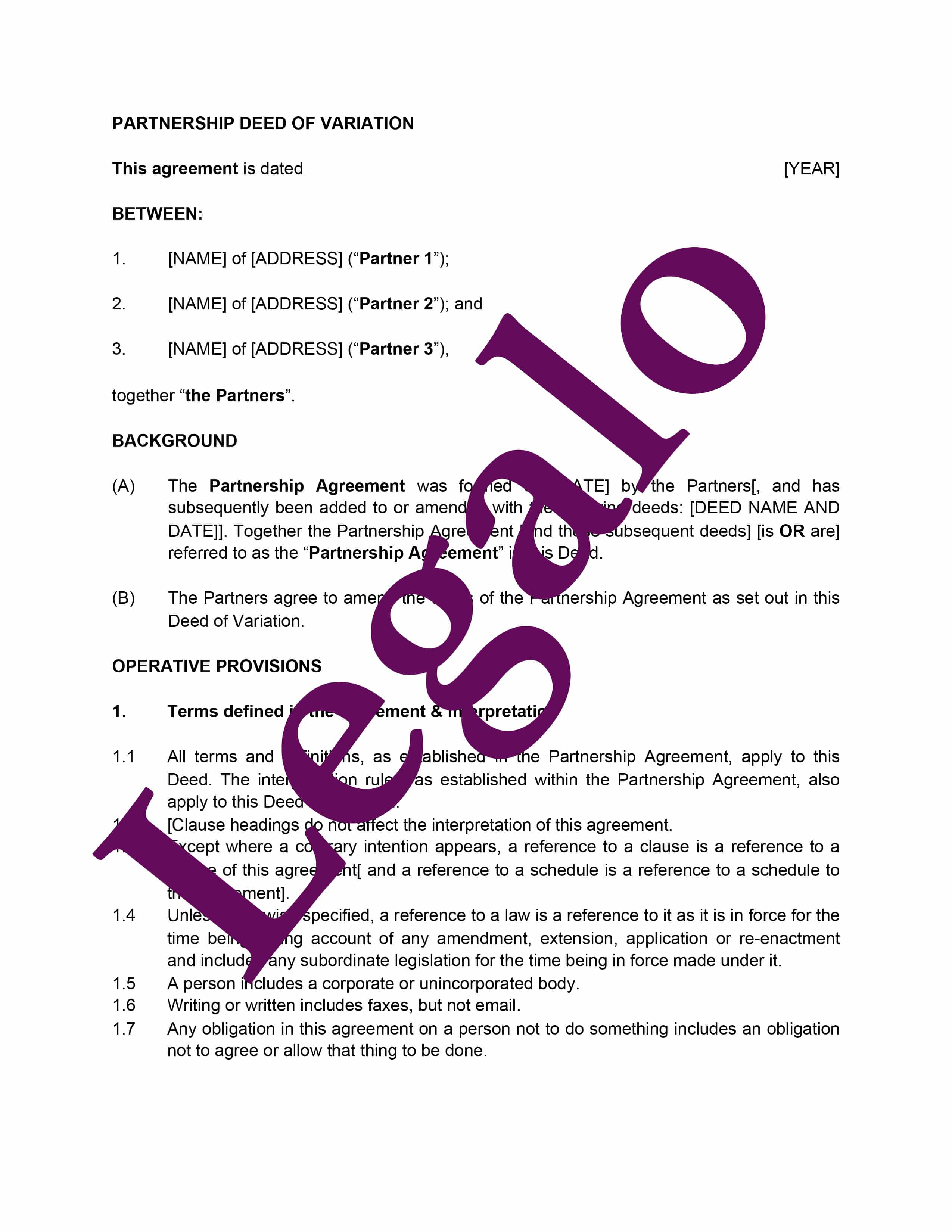

Partnership Deed of Variation template Legalo Ltd U.K.

Use this deed of variation template next time you want to update a business contract. Click on the image above to find out how you can try the full Deed of Variation template in Juro. Our templates are for general information only. You should not rely on them, and Juro is not liable for any reliance on them. The templates might contain errors.

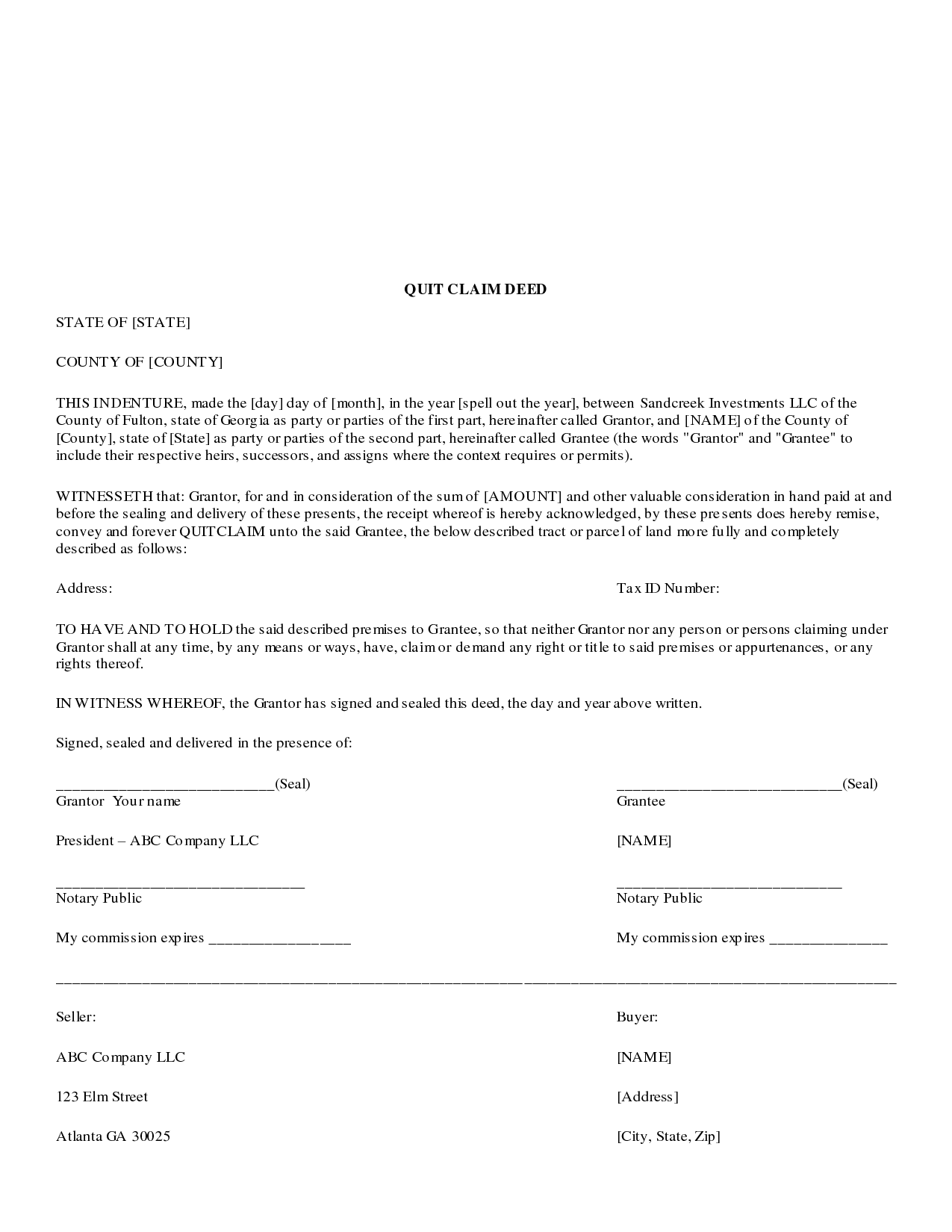

Fillable Short Form Deed Of Trust And Assigments Of Rents Printable Forms Free Online

Instead, Ryan decided to make a deed of variation and leave roughly £20,000 to charity (10% of the net estate). This caused the net estate to be reduced to £505,000, leaving a taxable estate of £180,000. It also caused the inheritance tax rate to be reduced to 36%. After leaving £20,000 to charity, the new inheritance tax bill was £64,800.

Deed of Variation Will The Legal Stop

The requirements for a valid instrument of variation are contained in section 142 IHTA 1984. These include the following: The variation must be executed within two years after the person's death.

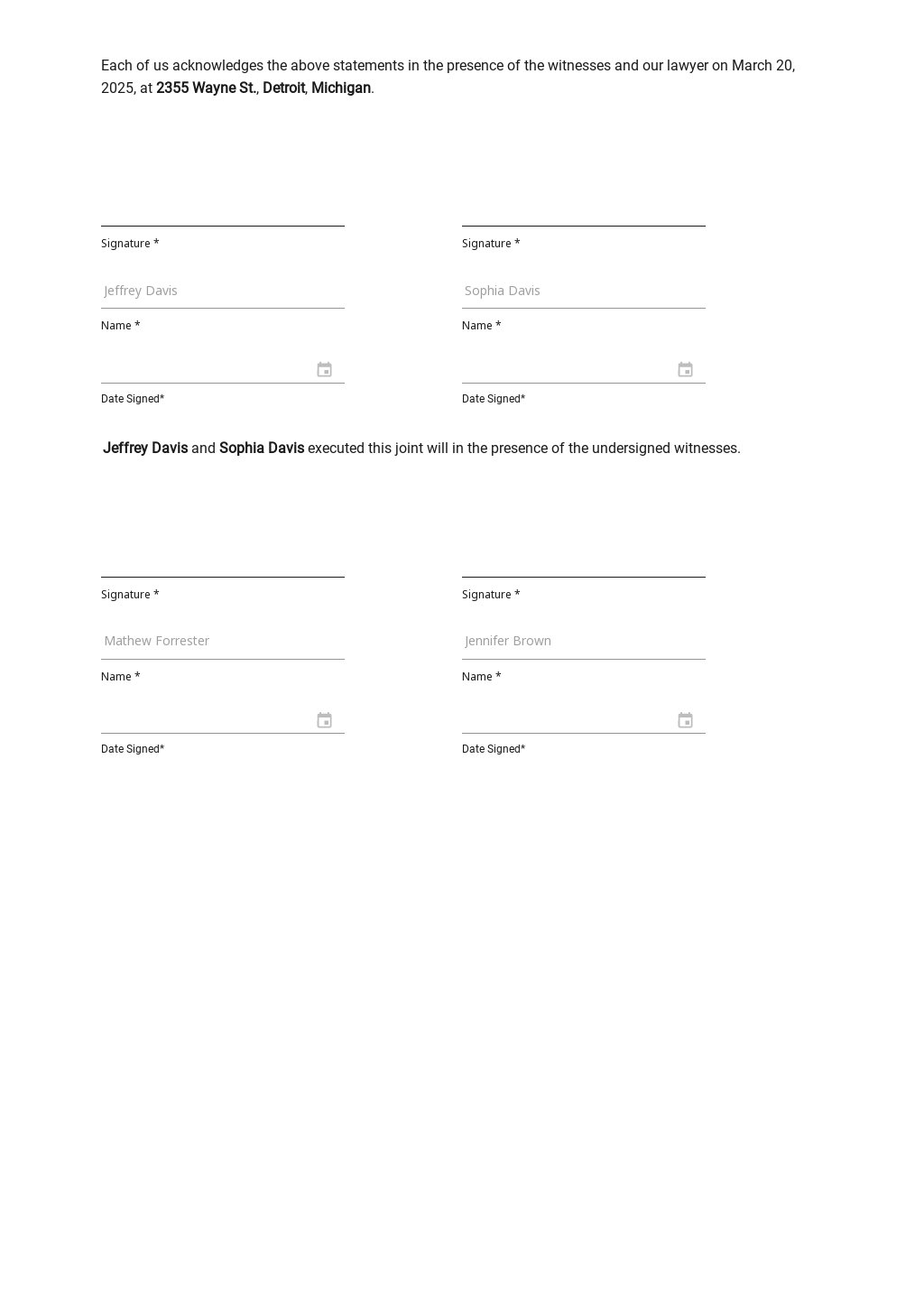

Married Couple Will Template

A deed of Variation on Intestacy is a legal document. It enables the allocation of a deceased person's estate to be varied where the deceased died without leaving a will. This guide explains how a deed of Variation can be used to vary an intestate estate. Specifically, when a person is entitled to an inheritance from someone who has died.

Variation Order Request form template A better way to manage VOR's

Deed of Variation cost. As we previously outlined this type of document is bespoke thus the cost can also be variable. A quite simple cost for a deed of variation is around £250 plus VAT however, deeds that transfer estates to a trust can vary on cost considerably. If you are unhappy with the cost for services elsewhere call us.

TheWill2Win Contested Probate, a Disputed Will and Power of Attorney 06062006 Deed of

Also known as a variation - or deed of family arrangement - this allows beneficiaries to rearrange or vary their entitlement. A deed of variation can be used by any person who receives a gift under a will to redirect their inheritance to another person. This person can be chosen irrespective of whether or not they are named in the will.

Variation of Discretionary Trust Sample Lawpath

A deed of variation for a will is a legal document that is used to change the terms of an existing will. It allows a beneficiary (a person inheriting under the will) to change the will of the person that has died (known as the testator). The deed of variation operates to change who inherits where someone has left a will.

Letter proposing variation of contract Docular

A Deed of Variation is a document that can be prepared for a beneficiary of a deceased person's estate that allows them to give up their entitlements under the deceased's Will or the intestacy rules in favour of other individuals. It can apply to anything in the estate such as land, cash, a share in the residuary estate or a beneficial.

Deed of Variation for a Lease Template Legalo, UK

What is a Deed of Variation? After someone dies, it is possible for the beneficiaries of their estate to make changes to the distribution of the estate, instead of directly following the terms of the will or the rules of intestacy. This can be done using a Deed of Variation, also known as an Instrument of Variation.

Variation Deed (To Amend an Initial Agreement) Template Sample

A deed of variation, as we outlined above, is a document used to make alterations to a person's will after they have died. Only beneficiaries of the will are entitled to make these kinds of changes. Deeds of variation: learn about what they are, why you might want to change a will & how to register your changes.

(PDF) Deed of Variation DOKUMEN.TIPS

A deed of variation lets you divert a gift from a will. With a deed of variation, you can change the way that a gift from an estate is distributed. You don't necessarily have to take formal legal advice, and you don't have to notify HMRC unless it's a taxable estate. But you'll need to complete the deed within 2 years of the deceased.

Deed Of Variation Will Free Template Templates Resume Designs A81BG7Mvao

What is a Deed of Variation? • A deed of variation is a legal document that allows you to change a Will or, in the instance there is no Will, change how the intestacy rules operate and apply to the estate. • It can be used to alter the distribution of assets, add beneficiaries, or make other changes to Will or Intestacy rules.

- Lemon Cheesecake Delia Smith Recipe

- Carrera Crosscity Folding Electric Bike

- Air Vests For Horseback Riding

- Beer Profit Margin Calculator Uk

- Marks And Spencer Thai Green Curry

- Vw Tiguan For Sale Ni

- Lebara Text Messages Not Sending

- Tyson Fury Next Fight Tickets

- Luxury Golf Gifts For Him Uk

- Jack Of Clubs Fragrance World