How Do I Claim Back Stamp Duty? SDLT Reclaim

It meant buyers would have to pay a 3% surcharge on top of existing SDLT rates. So for example, if you purchased a home for £400,000, you would pay: On the first £125,000 = £3,750 (no stamp.

How Do I Claim Back Stamp Duty · Greater London Properties (GLP)

The stamp duty refund and the rebate for all eligible EV purchases will end on 1 January 2024. Individuals and businesses that have purchased or placed a deposit on an eligible EV prior to 1 January 2024, and are awaiting delivery of the vehicle, will still be eligible to receive the stamp duty refund and rebate, regardless of whether the vehicle has been delivered by that date.

COVID19 interim measures on stamp duty announced by HMRC Tax Talks How do I claim back

Before you start Exemptions, concessions and reductions should be claimed during the property transfer process. This form is for people who overpaid duty or were unaware of an exemption, concession or reduction at the time of transfer. To avoid claiming a refund, apply for the exemptions, concessions or reductions via the Digital Duties Form at the time of purchase so you pay the correct.

(14).jpg)

How to claim Stamp Duty back Stamp Duty Rebates

How to request a refund. To request a refund from Revenue NSW, download and complete a Request for refund of duty on an application to register a motor vehicle (PDF, 225.3 KB). You generally need to apply for a refund within 5 years of buying your motor vehicle. You must provide the original certificate of registration showing duty was paid.

Stamp Duty Cut to Save homebuyers up to £2,500 Blog Estate Agents and Lettings Agents in

This means, for example, you will pay 8pc (5pc plus 3pc) on the value of a home valued between £250,000 and £925,000. And you will pay 13pc (10pc plus 3pc) on the value between £925,000 and £1.

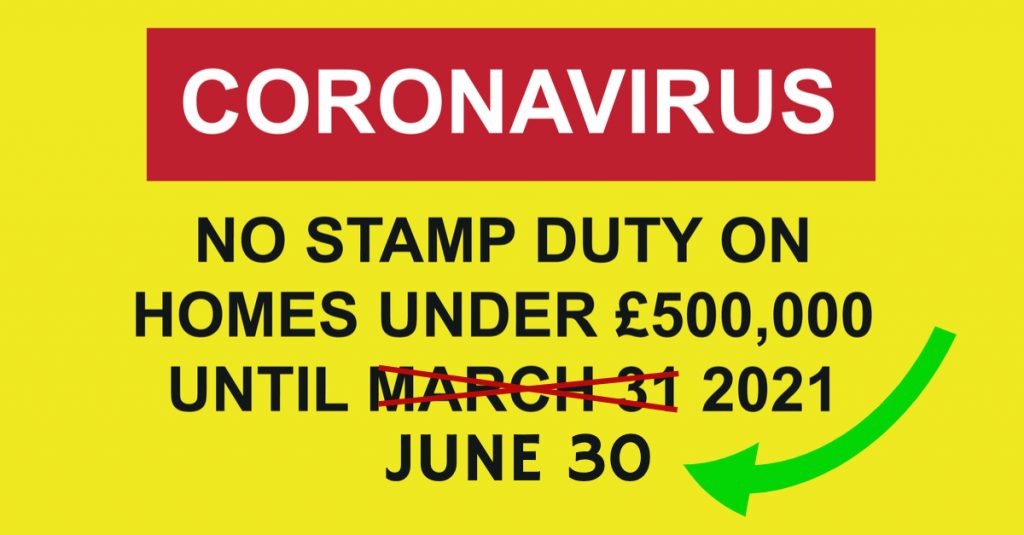

Extension of Stamp Duty holiday Country House Company

You can claim your stamp duty refund by completing an online form on the GOV.UK website. To start the process of claiming back stamp duty, you'll need: - Details of the property that attracted the higher rates of stamp duty, including the date of purchase and the unique transaction reference number. - Details of the previous main.

How Do I Claim Back Stamp Duty? SDLT Reclaim

You need to check the details of your purchase and then consider whether a stamp duty relief applies. In most cases, you have to make the refund claim to HMRC within 12 months and 14 days of completing your purchase. In cases of claiming back the 3% higher rates for replacing your previous main residence, your claim must be made within 12.

What Is BuytoLet Stamp Duty? Stamp Duty Rebate

To apply for a reassessment or refund of transfer (stamp) duty, send us the following documents within the relevant timeframe: a letter asking for a reassessment. the original stamped documents (unless otherwise advised) any correspondence between the parties confirming the reasons for the reassessment. a completed statutory declaration (where.

Find out how this UKbased tax consultancy is helping people claim back stamp duty from HMRC

Apply for a repayment. To apply for a repayment you can: use the online form. fill in the form on-screen, print it off and post it to HMRC. To use the online form, you need a Government Gateway.

Government announces new stamp duty rates for nonresidents from April 2021 M J Bushell

Apply online for a refund of duty. Alternatively, you can complete the relevant application form (select the transaction type below) and lodge your form online. You will need to provide supporting documents: the contract of sale of your property. the certificate of duty. a copy of your ID (such as your driver's licence) a copy of a bank.

🔴 How To Claim Back Stamp Duty 2024 Updated RECHARGUE YOUR LIFE

While you can't claim the cost of stamp duty on the property, the ATO does currently allow you to deduct certain "borrowing expenses" when you purchase an investment property, including: loan establishment fees charged by your bank or lender. the cost of preparing and filing your mortgage documents.

What is stamp duty and how does it work? Legal Home Loans

Stamp duty refunds are now online. Published on 03 October 2016. The SRO has enhanced its systems to now include online refunds of overpaid land transfer duty. Please use a Duties Online registered organisation to lodge on your behalf. Alternatively, apply for a refund by registering with us. Applications can no longer be lodged manually.

Stamp Duty What Is It and How to Avoid It on a Second Home? Review42

These include the completed Stamp Duty Land Tax Return, the SDLT5 certificate for your new house, proof of your previous property's sale or disposal, and any other supporting documents mentioned earlier. The forms and accompanying documents should be mailed to the following address: HM Revenue and Customs. BX9 1HD.

Stamp Duty explained Nested blog

To reclaim stamp duty through HMRC, you will need details of the purchased property - most importantly the effective date of purchase and the SDLT unique transaction reference number. You'll also need the details of the previous main residence you've sold, including the effective date of sale, the address of the property and the name of.

The IFS is quite right here, stamp duty is largely paid by pensioners — Adam Smith Institute

You must pay transfer duty - once known as stamp duty - in NSW when you buy: property, including your home or holiday home. an investment property. vacant land or a farming property. commercial or industrial properties, or. a business, which includes land. You must also pay transfer duty when you acquire land, or an interest in land.

Complete Guide to Stamp Duty Relief Period

Conclusion. If you want to find out whether you are entitled to obtain any stamp duty refunds please feel free to contact our office on 03 9708 5564 or by filling in the form below. We offer a fixed fee refund service of $880.00 (GST inclusive).

- Freestanding Plug In Electric Radiators

- Metal Wall Art Of Birds

- Horstmann Electronic 7 User Guide

- 4 Wheel Shopping Trolley For Elderly

- 2024 Diary A5 Week To View

- Notepad With Post It Notes

- Fishing Lodges With Private Swims Uk

- Snapchat My Eyes Only Nudes

- Proxima Nova Font Free Download

- Velvet Self Tie Bow Tie