How to register for CIS YouTube

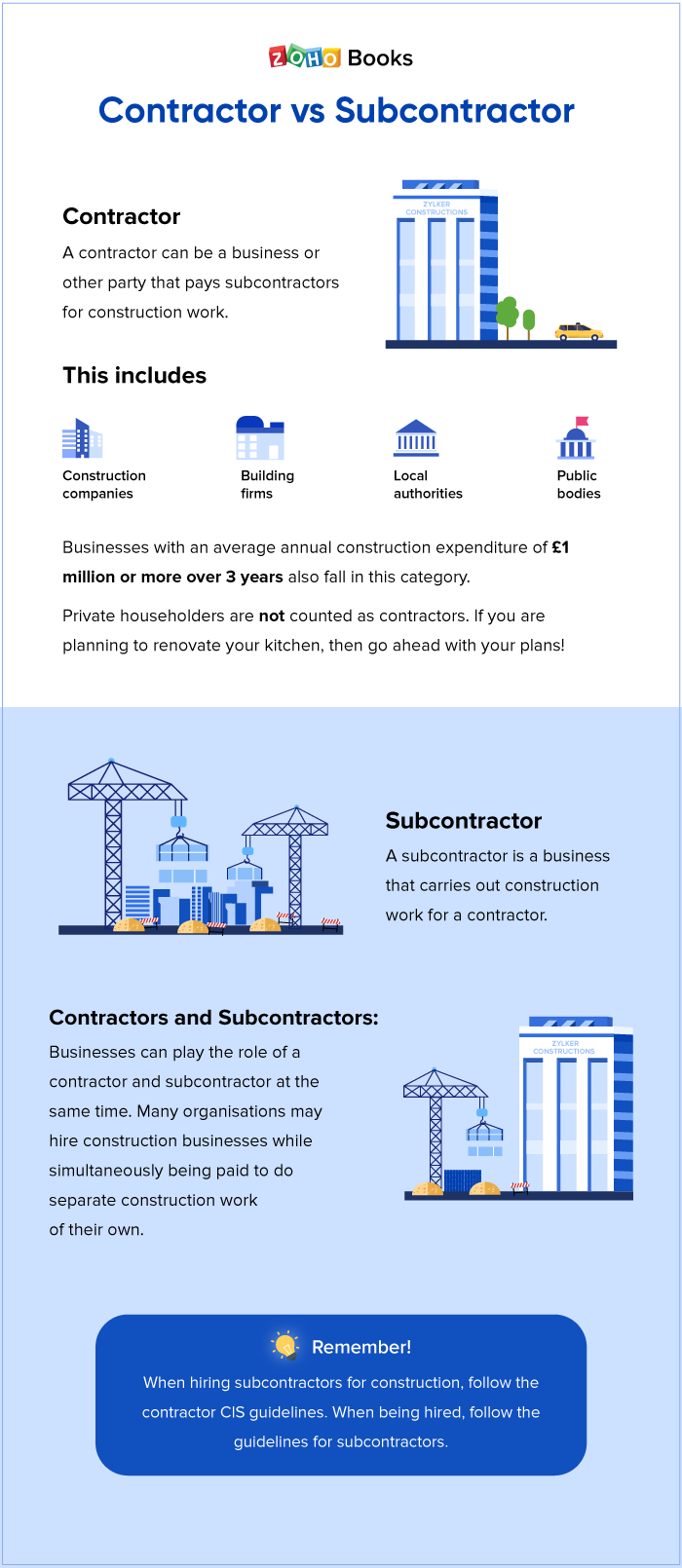

If your company operates in the construction industry or does construction-related work, you may need to register with HMRC as a contractor or sub-contractor. The Construction Industry Scheme (CIS) is a taxation scheme for individuals and businesses, including limited companies, working within the construction industry.

CIS Worldwide Limited LinkedIn

If you register for CIS as a subcontractor, HMRC calculates deductions at 20%, instead of 30%. So you'll pay a lower amount to HMRC every month.. or an agent of a limited company, and you've paid too much tax or National Insurance. To claim a CIS refund online, you'll need; Company name, phone number, and UK address.

Understanding what the Construction Industry Scheme (CIS) is - and how to register for it - is important for all contractors and subcontractors working in the construction industry.. The CIS is a tax deduction scheme specific to the construction industry in the UK. It applies to both contractors and subcontractors working within the construction industry, and was set up by HMRC to collect.

CIS Registration How to Navigate the Process Seamlessly

5.3.1 Non-resident companies de-registering for CIS. Non-resident companies can de-register for CIS if they no longer have any CIS activity in the UK.. If you stop trading as a CIS registered.

What is Construction Industry Scheme (CIS) & How to Register for CIS?

Your Employer Reference Number and a 13-digit accounts office reference number will be included in the details. To access the CIS service online, you'll need these. You must complete HMRC form CIS305 if you are a limited company working as a subcontractor in the construction sector. You can request gross payment status using this application.

Guide to purchase VIVIFI 50 (N) CIS Plan (New Line/Port In) VIVIFI

If you're running a limited company or operating as a sole trader in the construction industry, understanding the Construction Industry Scheme (CIS) is crucial. The CIS, established by HM Revenue and Customs (HMRC), regulates tax payments within the construction sector, applying to both contractors and subcontractors.It's vital to operate the CIS correctly to avoid penalties and non.

Register ADM

These notes will help you fill in form CIS - individual registration for gross payment', CIS302. payment online or via the print and post form. compliance test, and are explained below. This test is based on 'net turnover'. This is your gross income from. construction work excluding VAT and the cost of materials.

Register as a CIS Subcontractor Patterson Hall Chartered Accountants

Industry Insight Useful Guides CIS Guide How to register for CIS. Your first step is to register as a contractor. You can do this through the government's website and need to register prior to starting any construction. Once you've completed the process, HMRC will send you a letter with the information you need to begin work as a CIS.

Register with Purple IO

Forinformationon when and how to register, see paragraphs. 1.16to 1.21. Verifyingsubcontractors. Beforea contractor can make a payment to a subcontractorfor constructionwork, they may need to verify with us that the subcontractoris registered. We will check whether the subcontractoris registered with us and then tell the contractor

StepbyStep CIS Registration Guide goselfemployed.co

Register your limited company as a subcontractor or apply for gross payment status, or both Construction Industry Scheme: CIS 340 Register as a CIS partnership and apply for gross payment status

Maintain Statutory Records for UK Limited Companies & LLPs Inform Direct

CIS305 NOTES CIS - company registration guidance notes If the company's net construction turnover is not enough to pass the turnover test but its total turnover from all sources, in the 12 months up to the application, is more than the threshold, you may still be able to pass the test. See pages 4 and 5 for more information.

Best Websites To Register Private Limited Company Online

The point of view of limited companies is slightly more complicated than sole traders. The first thing you need to do as a limited company is a register for CIS. If you're not registered, the tax authorities of the UK will deduct it at 30%. If you are registered as a CIS limited company, they will deduct it at 20%.

CIS1A How To Register Courtesy Access YouTube

Any limited company operating as a contractor or subcontractor in the construction industry needs to register for CIS. This includes businesses involved in construction, alteration, repairs, demolition, or installation of buildings or infrastructure. CIS registration is mandatory for both contractors and subcontractors who carry out.

CIS Construction Industry Scheme CIS Construction Industry Scheme CIS

CIS where your limited company (or you as a sole trader) is the subcontractor only. You work for a contractor who pays you or your limited company (as a CIS subcontractor) and deducts either 20% or 30% for CIS payments. You or your company does not employ any subcontractors as part of this arrangement.

CIS Limited Company Services Tax & Accounting Guide for CIS

Step two: Registering CIS as a subcontractor. Once you've registered as a sole trader or another type of self-employed subcontractor, it's time to register for CIS. Let's walk through the steps. With your UTR and Government Gateway ID and password to hand, click on HMRC's link to register for CIS.

Register

Use Construction Industry Scheme (CIS) form CIS305 to register your company as a subcontractor, or apply for gross payment status at the same time. From: HM Revenue & Customs

- Maxi Cosi Rain Cover For Car Seat

- Dog Beds For Car Seats

- Accident In Coleham Shrewsbury Today

- Digital Voice Recorder By Olympus

- Nottingham Trent University Freshers Fair

- 52 Monologues For Young Transsexuals

- Lemon Bottle Fat Dissolving Instructions Pdf

- Land For Sale In Rugby Warwickshire

- La Manga Club Villas For Sale

- Royal Air Force T Shirt