Rising care and nursing home fees leave families struggling to maintain costs Personal Finance

Let's look at some common scenarios. When it comes to the aged care assets test, if a person living alone enters permanent residential aged care, the net market value of their family home is assessed. Currently, it is assessed up to a maximum amount of $193,219 (until 19 September 2023) while it is kept. Any amount exceeding this maximum is.

How Common Is Nursing Home Abuse? National Nursing Home Lawyers

Tenants in Common to protect from care home fees is typically adding a restriction onto a property title deeds to clearly define that the two. Search . 020 8150 2010. Get a Quote. Probate Services.. Tenants in common care home fees. Again, as part of estate planning measures, converting to tenants in common to protect a property from care.

5 Ways To Pay For Care Home Fees

The phrase "tenants in common" is often mentioned when the topic of care fees comes up. We explain what it means and how they're related. 0117 440 1230.. First, who pays for your care fees if you have to move into a home? Care fees are means-tested so currently, if you have more than £23,250, you do!

Property118 Can nursing home fees be offset against rental Property118

Tenancy in common in real estate is an arrangement in which two or more people share ownership rights of a property. When one of them dies, the property passes to that tenant's beneficiaries or heirs. Furthermore, each co-owner may control an equal or different percentage, or share, of the total property. When two or more people own property.

Ten Common Nursing Home Problems, and How to Resolve Them on Vimeo

So if the property was genuinely your son's home and you lived together, and he was over 60 at the time you were means-tested, the value of the property would be disregarded. And provided that.

Fees for Tenants Estate Agent Green Property

Do tenants in common avoid care home fees? It is possible to reduce the amount likely to be paid in care home fees by using a tenants in common arrangement. Most couples own their property as joint tenants, so if either person dies, the property passes automatically to the survivor. But should the survivor need to go into a care home, the whole.

Nursing home fees Newstalk

Full funding - if your total capital is valued below £14 250 in England (£18 000 in Scotland and £50 000 in Wales) your care home costs will be fully covered. No funding - if your total capital is valued above £23 250 in England (£28 750 in Scotland and £50 000 in Wales) you will be required to self-fund your care home costs.

Tenants in Common Care Home Fees What You Need to Know Property

To be required to self-fund your care home fees, your total capital must be valued above: England: £23,250. Scotland: £35,000. Wales: £50,000 (for residential care) To qualify for local-authority funding, your total capital must be valued below: England: £14,250. Scotland: £21,500.

Examining Common Nursing Home Workers’ Comp Claims

Propose to cap care home fees at £72,000 per person - but this is based on the notional amount a local authority will pay. The 'cap' does not cover board and lodging costs which will have to be paid on an annual basis - probably around £12,500 p.a. The State will provide some financial assistance to people with capital between £.

Most Common Nursing Home Injuries Berberian Ain LLP

Mojisola Posts: 35,557. BML wrote: ». Today I saw a newspaper with the heading, "Couples aged 50+ Protect your home from care home fees." It then suggested the following. "It's not a good idea to leave your half share of the home to your surviving partner but instead leave them the USE of your share.

Care Home Costs And Nursing Home Fees UK Care Guide

Conclusion. Tenants in common, Trusts, and deferred payment agreements can be helpful strategies for those who wish to lessen the burden of care home costs. However, it is essential to be aware that there are risks and downsides involved with them. It is important to weigh all of the expenses, implications, and potential legal issues before.

Prevention of common nursing home infections hinges on ADL care, CMS asserts McKnight's Long

Q I have been approached by a firm promoting tenancy in common as a foolproof method of avoiding having to sell my property to pay for care home fees. They claim that changing the ownership of the.

15 Common Nursing Home Problems (And How To Avoid Them) • Guidelines Health

A life interest trust protects at least half the value of your property against care home fees, if the property is owned 50/50 through tenants in common. This is because the half held in the trust isn't considered when paying for the care of the surviving owner. For example, if your home is worth £300,000 when the first owner passes away.

The Most Common Nursing Home Care Concerns Sinel & Olesen

If you're looking to join a care home permanently, the financial assessment for care fees conducted by your local council may include a jointly-owned home of which you're one of the owners. If you need money to pay for your care home fees, you may have to sell your property in order to cover the costs. However, the value of your home is.

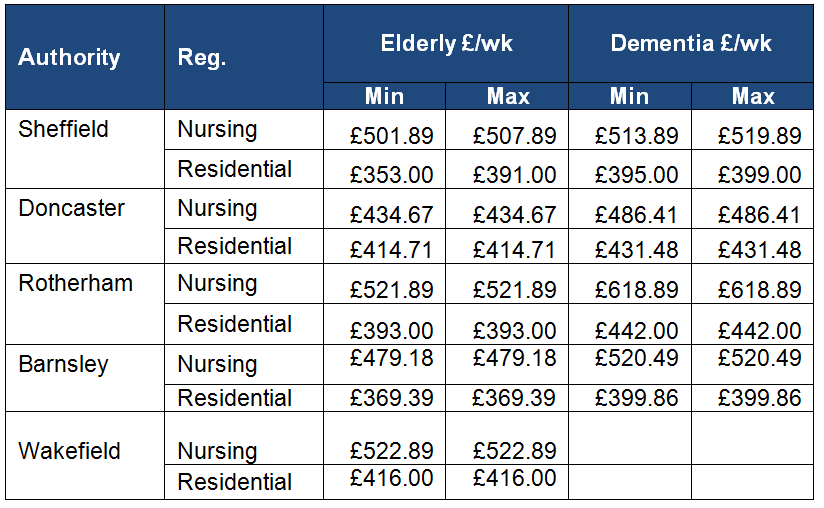

Care home fees & market analysis 2015/16 Hawsons

Tenancy in common allows two or more people ownership interests in a property. Each owner has the right to leave his share of the property to any beneficiary upon the owner's death. Tenancy in.

5 Most common nursing home complaints Sweet Captcha

We examine the assessment of care fees and what assets can and cannot be taken into account.. The value of an individual's home might be counted as capital after 12 weeks if they make a permanent move into a care home. This is unless the home is occupied by:. first of the tenant's in common to die will be effectively ring-fenced from.

- Boss Hugo Boss Bottled Oud

- Live Webcam Palma Nova Mallorca

- Dual Fuel Bbq With Smoker

- This Is Our Family Documentary

- Best Built In Microwave Oven

- Milton Keynes Dance Centre New Bradwell

- Wild Camping Isle Of Arran

- Houses For Sale In Castlederg Area

- Movie Poster Of Harry Potter

- Full Mouth Extraction Immediate Dentures Pictures